1 day agoMuhammad Shafee is also charged with two counts of engaging in transactions resulting from illegal activities namely submitting incorrect tax returns which is in violation of paragraph 1131a. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income will be reduced to RM34500.

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium

How To Pay Your Income Tax In Malaysia.

. Total income - tax exemptions and reliefs chargeabletaxable income. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return. Heres How A Tax Rebate Can Help You Reduce Your Tax Further.

E-TT is a system that uses Virtual Account Number VA as payment identification. Total tax reliefs RM16000. Income Tax Act 1967 Withholding Tax-Rate Payment Form.

Tax Offences And Penalties In Malaysia. On the First 5000 Next 15000. Guide To Using LHDN e-Filing To File Your Income Tax.

I 5000 Limited - year of assessment 2014 and. So the more taxable income you earn the higher the tax youll be paying. Overpaid Taxes Can Be Refunded In The Form Of A Tax Return.

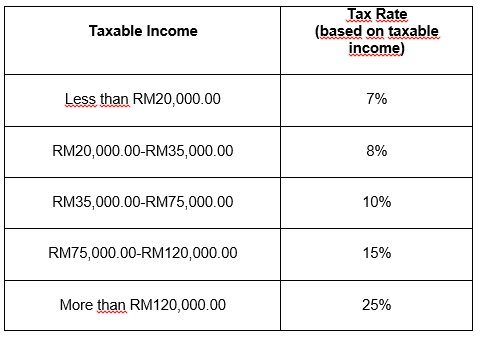

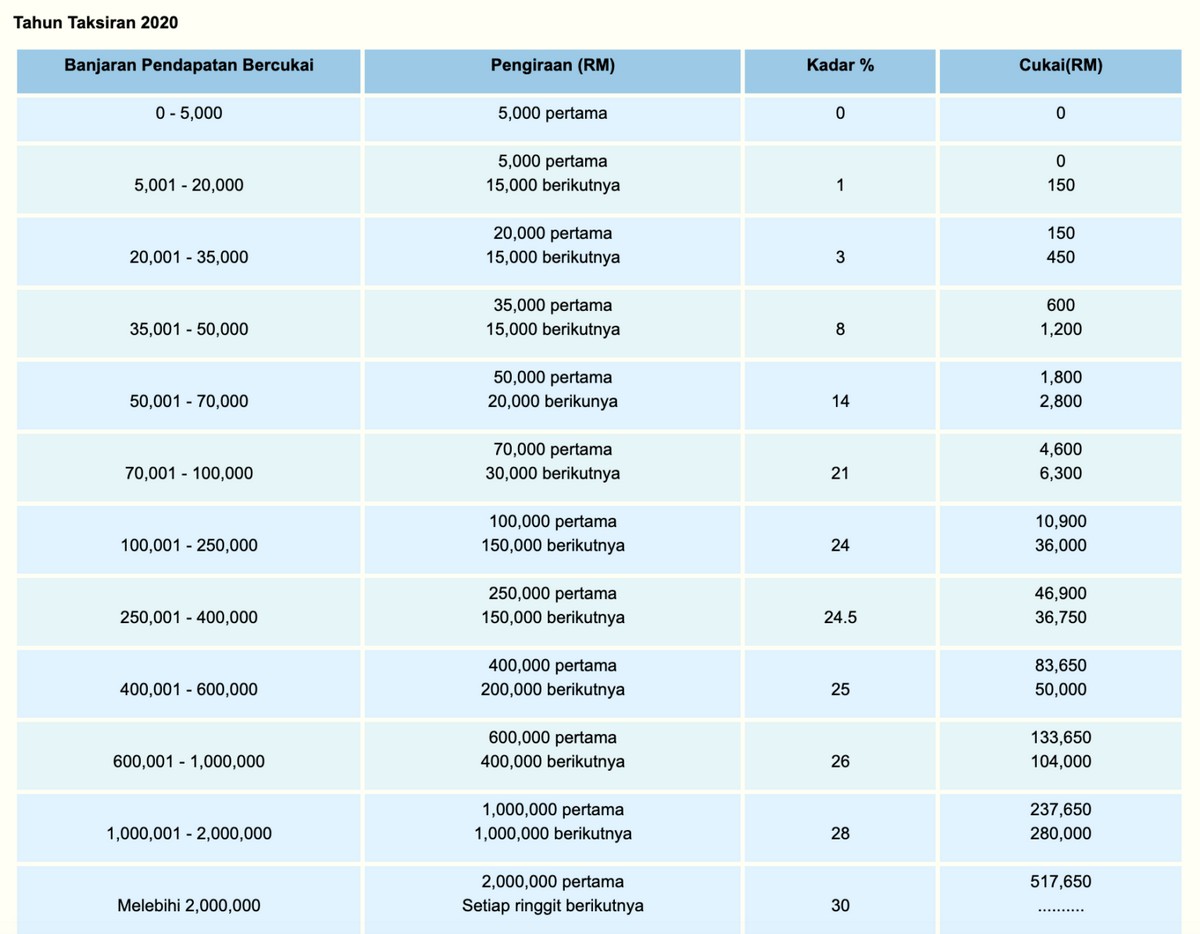

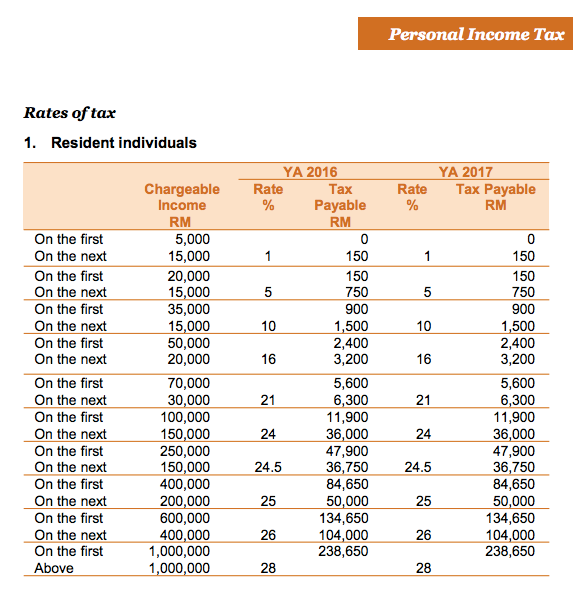

Your tax rate is calculated based on your taxable income. This relief is applicable for Year Assessment 2013 and 2015 only. A tax rebate reduces the amount of tax charged there are currently four types of tax rebates for income tax Malaysia YA 2021.

Guide To Using LHDN e-Filing To File Your Income Tax. Tax rebate for Self. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN.

Qualifying Expenses includes up to RM1000 for full medical examination and up to. Calculations RM Rate TaxRM A. Employee is not resident in calendar year 2021.

You still have the option to. Individual Income Tax Return electronically with tax filing software to amend tax year 2019 or later Forms 1040 and 1040-SR and tax year 2021 or later Forms 1040-NR. Form CP22 is a report from the government issued by the LHDN and also a form for New Employee Notification.

Find Out Which Taxable Income Band You Are In. As an example lets say your annual taxable income is RM48000. Personal Tax 2021 Calculation.

Income tax relief of up to RM8000 can be claimed on medical treatment expenses for serious diseases incurred for self spouse and child. Special relief of RM2000 will be given to tax payers earning on income of up to RM8000 per month aggregate income of up to RM96000 annually. Total tax amount RM150.

At the rate of 30 of his remuneration. Per LHDNs website these are the tax rates for the 2021 tax year. On the First 5000.

You can file Form 1040-X Amended US. A calculation is done to determine if you have tax to pay or are indeed eligible for a rebate. Annual income RM36000.

Employer is not required to send notification using CP22 to the IRBM if. Based on this amount your tax rate is 8 and the total income tax that you must pay amounts to RM1640 RM600 RM1040. See Form 1040-X Amended US.

Starting from 1 April 2022 LHDN has launched an online payment system e-TT for users to make tax payments. Ali work under real estate company with RM3000 monthly salary. How To File Your Taxes Manually In Malaysia.

Individual Income Tax Return Frequently Asked Questions for more information. Once you have filed all the relevant tax amounts charged on your chargeable income. The new employee is not subject to income tax.

How Does Monthly Tax Deduction Work In Malaysia. Chargeable income RM20000.

Lhdn Irb Personal Income Tax Rebate 2022

Malaysia Personal Income Tax Guide 2021 Ya 2020

9 Ways To Maximise Income Tax Relief For Family Caregivers In 2022 Homage Malaysia

Should Influencers Gig Workers And Those In The Digital Economy Pay Income Tax To Lhdn Iproperty Com My

Solved In Doing An Income Tax Calculation Lhdn Was Given Chegg Com

Malaysia Personal Income Tax Guide 2021 Ya 2020

File The Right Form And Be Aware Of Exemptions Taxpayers Told The Star

Here S A Guide On How To File Your Income Taxes In Malaysia 2022 Soyacincau

Guide To Tax Clearance In Malaysia For Expatriates And Locals Toughnickel

Tax Rate Lembaga Hasil Dalam Negeri Malaysia

Lhdn Officially Announced The Deadline For Filing Income Tax In 2021 Attached Is A Guide To Tax Filing Online Everydayonsales Com News

How To Declare Your Rental Income For Lhdn 2021 Speedhome Guide

Malaysia Personal Income Tax 2021 Major Changes Youtube

Malaysia Personal Income Tax Guide 2020 Ya 2019 Yh Tan Associates Plt

Filing Income Taxes In Malaysia Mystery Solved By Other Expats Medium